And the president most to blame for the national debt problem is …

FACT CHECK: US Debt by President | Chart & Per President Deficit | Self.

The Growth of the National Debt Under President Biden

Durham Report Proves GOP Electorate’s Worst Fever Dreams Are Totally True.

This article will dive into how much each President has contributed to National Debt,

the types of decisions they make that impact debt levels the most and the events that

have shaped America’s economic reality throughout history.

Key Stats: IRS whistleblower who alleged political interference

in Hunter Biden investigation taken off case: report (msn.com).

Hunter Biden IRS Whistleblower: What Happened? (msn.com)

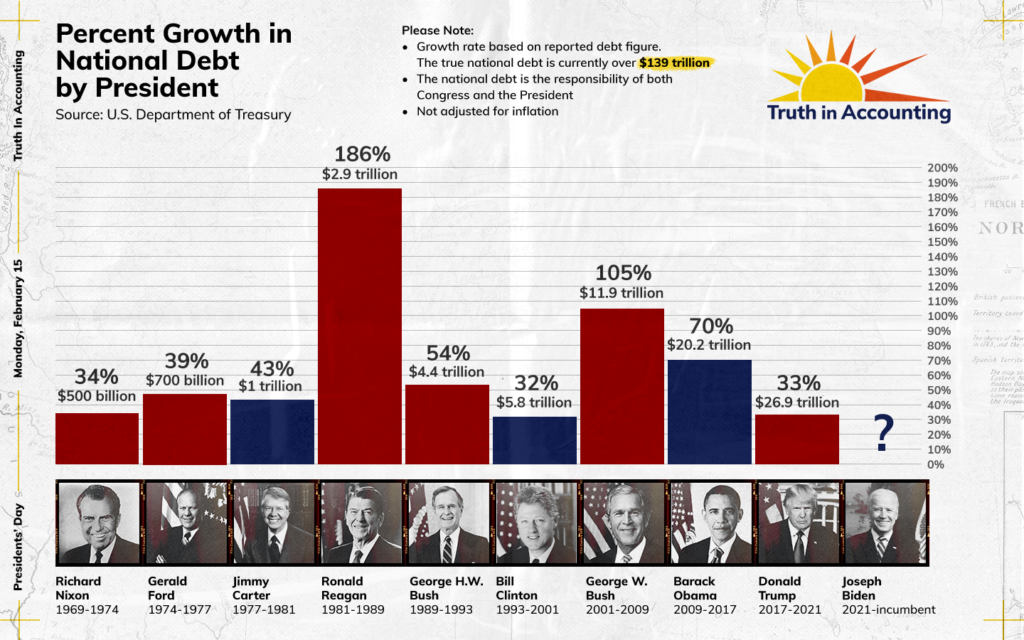

National debt during Joe Biden’s presidency has increased by $2.5 trillion since he

took office, an increase of 8.79% as of September 2022. During Donald Trump’s whole presidency, the U.S. national debt increased by $8.18 trillion, a percentage increase of 40.43%. This is less than Barack Obama (69.98%) and George W. Bush (105.8%).

But Donald Trump was in office for only 4 years compared to 8 years for both Barack Obama and George W. Bush. However To tackle the COVID-19 pandemic, national debt was increased by a further 18.01% totaling $4.25 trillion

in additional debt from March 2020 to Jan 2021 & Democrat Spendfest Stimulus Package.

Abraham Lincoln’s years in the Oval Office saw the largest percentage

increase in National Debt under any President, increasing 2859% overall

However, Martin Van Buren is the President who spent the most consistently

with average yearly debt increasing 375.32% compared to Lincoln’s 148.36% .

Woodrow Wilson, who was President during World War 1, oversaw an increase

of 722.21% (averaging 35% increase per year in office),

Franklin D. Roosevelt, in office between 1933 – 1945,

increased National Debt by 1047.73% (24% increase per year on average)

Of the 45 Presidents, only 14 of them have overseen a decrease in debt.

Calvin Coolidge was the last President to do so, leaving office in 1929,

15 Presidencies ago. Andrew Jackson is the President who decreased

the National Debt the most, nearly eradicating it completely between

1829 – 1837 by reducing the total by -99.42% .

Why can’t our government? Just print money to get us out of debt?

How long do you think it will take the US to work off its current $40 trillion in debt?

Current Debt 31.8 Trillion USD World Debt Clocks (usdebtclock.org)

When Joe Biden was sworn in as President of the United States on 20 January 2021,

the U.S. national debt stood at $27.76 trillion. One year later, the total public debt outstanding of the U.S. government has ballooned by nearly $2.11 trillion (or 7.6%) to $29.87 trillion.

Perhaps a better question to ask is to whom does

the U.S. government borrow n’ owe all the money it has borrowed?

The following chart illustrates who the U.S. government’s biggest creditors

are as of the end of President Biden’s first year in office along with the portion

of the national debt they are owed.

Who’s to Blame for Bumping Up America’s Debt?

– President Biden and Congress continue to attempt to reach an agreement on the

$31.4 trillion cap on government spending before the looming deadline in early June.

In fact, a new meeting is going to occur today. While it does no good to point fingers

at who’s to blame for the massive debt, the limit of which was hit back in January,

both sides are very good at it.

The Debt Stalemate

The latest meeting between House Speaker Kevin McCarthy last Tuesday

evening failed to make any progress on conciliation around government spending.

Waiting things out is nothing new for McCarthy. It took 15 rounds of voting and four

days of debate and negotiations for him to finally take his seat as Speaker.

While McCarthy made concessions to ascend to the highest position in the House,

when it comes to America’s budget, the Speaker is not budging. Nor should he.

The irresponsible spending by both parties has continued for too long. Sure, it’s quite simple to continue to raise the debt ceiling – again. So simple, it’s been done 78 times since 1960 – 49 times under Republican presidents and 29 times under Democratic presidents.

But doing so should come with restrictions. Ones that ensure rigorous cost-benefit analysis is undergone before new programs are enacted. Congress must curb the pork barrel in D.C., costing Americans millions of dollars in inflationary costs.

Who’s Paying the Price?

Contrary to popular belief, the majority of American debt is not held by foreign entities such as China. The US adversary actually holds about $1 trillion of our debt, and while that may seem like a big number, it’s relatively small compared to the entire amount, less than 5%.

Americans hold our own debt and we are the ones paying the price.

The Consumer Price Index increased almost 5% over the past 12 months. Keep in mind that the CPI doesn’t account for increases in common household goods such as food, gas, and clothing – just a few of the items that have skyrocketed over the past two years, thanks to an increase of about 50% in federal spending between fiscal years 2019 and 2021, largely due to the pandemic.

While the increase in expenditures was understandable due to shutting down the economy during the pandemic, like most government payments, there was no significant debate about the future cost of doing so.

A typical household can now expect to pay up to between $350-$500 per person per month for groceries, depending on the state. Of course, if you’re living in cities such as

Los Angeles or New York, that amount will get you some bad coffee, donuts, and Ramen noodles.

If you’re attempting to eat healthy and invest in preventative care to reduce massive health care costs down the road, that number is going to jump closer to $600-$700 per month, possibly more if you include alternative treatments such as acupuncture, chiropractic,

or physical training or therapy.

Just like in any household, balancing a federal budget happens in two ways; increasing money in or decreasing money out. When it comes to the government, the main source

of revenue is taxes. The government’s highest bills come from Social Security, healthcare, defense, and interest on the debt. And who’s going to touch Social Security?

Just look at what happened in France.

Who’s to Blame?

Democrats blame Republicans for using the debt ceiling

as leverage to force spending cuts. But why shouldn’t they?

Imagine you’re a parent and your sixteen-year-old gets in a car accident. You get the car fixed because he promises to be more careful next time. He gets in another accident. You get the car fixed again, no questions asked. No grounding. No requiring him to pay for his own insurance. No restrictions on when he can drive. He gets in another accident and this time, he totals the car. You get him another car. You get the point. It’s ridiculous to expect more responsible behavior from a child without consequences for irresponsible behavior.

Is the government really any more disciplined or accountable than a teenager?

Republicans blame Democrats for continuing to pass and enact excessive and expensive programs under the threat of climate change and necessity for “diversity and inclusion.”

They have a point. The Democrat’s Green New Deal cost over $2 trillion.

Still, the biggest expenses continue to be income support and health care.

Republicans haven’t been any better with tightening their belts. They’ve raised the debt ceiling almost twice as many times as Democrats and President Trump raised it three times during his tenure in the oval office.

This battle over the budget is nothing new. The past two months look eerily similar to 2011 when Obama wrestled with then House Speaker John Boehner from Ohio over the debt ceiling increase and reductions in spending. The battle came complete with divisive factions within the Republican party and Boehner telling Republicans unhappy with his proposed plan to “get your ass in line.”

According to a Rasmussen Report poll, 56 percent of the respondents would rather

have a partial government shutdown until Congress can cut spending or keep it the same.

Only 34 percent said they would rather see the opposite, higher spending levels, to avoid a government shutdown.

The definition of insanity is doing the same thing over and over again and expecting different results. It’s time to stop the insanity once and for all. If a threat of default

is the only way to do it, so be it. It seems the people agree.

— Biden’s, remarks on the national debt ceiling in Valhalla, N.Y., May 10

As he heads to a showdown with House Republicans over raising the debt limit, the president has sought to add context to the discussion over the nation’s $31 trillion in debt. He has noted that debt has accumulated over the past 200 years. And while Republicans peg Biden as being a big spender, he has pointed the finger at his predecessor, Donald Trump.

NOTED: Trump tamed spending until the Democrats went hog wild on covid stimulus spending? Trump, Biden said, increased the national debt by 40 percent in his four-year term.

He added that, besides the pandemic, the biggest contributor to the national debt “over the last decade” was the tax cut passed in 2017 and signed into law by Trump. The implication is that if Republicans are looking for someone to blame for the size of the national debt, it should be Trump.

Biden has a point about the increase in debt under Trump.

Using the Treasury Department’s “debt to the penny” website, we can see that the nation’s total public debt, including intragovernmental holdings, was just under $20 trillion when Trump took office in 2017. Four years later, when Trump left, the figure was about $27.8 trillion. That’s an increase of nearly 39 percent.

(The debt has increased an additional 13 percent since Biden became president.)

But numbers can be deceiving. The Treasury website also shows that $4.3 trillion in debt — more than half of the $7.9 trillion increase — came in the last 10 months of Trump’s term, as the coronavirus pandemic emerged, and massive government spending was needed to mitigate the economic fallout. Both parties strongly supported such measures; Biden has criticized Trump’s handling of the pandemic but he has not questioned the level of government spending needed to combat it.

It’s in Biden’s political interest to focus on Trump. But his attack is a bit misplaced.

Policy choices made long ago are more responsible for the fiscal state of the nation.

Assigning a particular president responsibility for a debt increase is rarely productive, because so much depends on factors beyond a president’s control — an economic crisis such as the Great Recession or the pandemic, for example.

(The White House declined to comment for the record.)

The Impact of social programs

The main reason the United States has federal deficits, which year after year add to the national debt, is because of “fiscal imbalance.” Simply put, that means the government is not collecting enough money through taxes and fees to pay for public programs and services it has enacted or promised. If actions are not taken to close that gap, the problem gets worse over time.

Which president has contributed the most to the nation’s long-term fiscal imbalance?

That would be Lyndon B. Johnson, according to a 2021 study by Charles Blahous, a former economic adviser to George W. Bush and a public trustee for Social Security and Medicare from 2010 through 2015. Through an exhaustive study of Congressional Budget Office and Office of Management and Budget reports, Blahous estimated LBJ’s share of the fiscal imbalance is 29.7 percent.

Close behind is Richard M. Nixon, with 29.2 percent.

Johnson enacted Medicare and Medicaid in the mid-1960s, and then Nixon in the early 1970s expanded both programs and also enhanced Social Security so that benefits were indexed to inflation. Social Security and Medicare are now so popular that both Biden and Republicans have pledged not to touch them as they haggle over other types of government spending.

But in effect, according to this analysis, almost two-thirds of the nation’s long-term fiscal imbalance is a result of policy choices made more than 50 years ago. Spending on Social Security and Medicare happens automatically, not subject to annual appropriations made by Congress. So lawmakers would have to pass new laws to restrain spending in those programs, which are called “entitlements” because benefits are guaranteed for all who qualify. The cost of some of these decisions in the 1960s only became apparent much later.

Former LBJ White House aide Joseph A. Califano Jr. in 1993 disclosed that a seemingly minor provision to provide nursing-home coverage that was added to ensure passage of Medicaid, the health-care program for the poor, unexpectedly led to a gusher of cash from the federal government that helped build what is now a $150-billion nursing-home industry; one-third of Medicaid personal-health spending goes to nursing homes.

To pry Medicare out of a Senate committee, Johnson also agreed to pay hospitals a certain percentage above hospital-determined costs and accept doctor fees that were considered “reasonable,” “customary” and “prevailing”— a compromise that at the time he was told would cost just $500 million. Since then, lawmakers have struggled with the spiraling consequences of giving “hospitals and doctors the keys to the federal Treasury,” as Califano put it.

> Related video: Debt ceiling is a crisis ‘but it’s no different than 2011’.

You can’t evaluate the effectiveness of policies just by looking at costs. Social Security and Medicare helped mitigate poverty among the elderly. Indexing Social Security benefits to inflation gave the program a feature that virtually no annuity can match — and also has ensured the elderly do not suffer economically during periods of high inflation.

Social programs, in fact, can provide more benefits than costs in the long run, but it’s not easy to document because the returns may take decades to materialize. A 2020 analysis by Nathaniel Hendren and Ben Sprung-Keyser of Harvard University of 133 policy changes found that spending on low-income children’s health and education in particular paid for themselves. That’s because children who benefited from those programs earned more money as adults, thus paying higher taxes and requiring fewer welfare payments.

NOTE: Children’s health programs, for instance, were estimated to earn the government

$1.78 for every dollar spent. Spending on adults did not have the same kind of long-term impact, the analysis found.

The Impact of tax cuts

Biden, in his remarks, said: “Over the last decade, the single largest contribution to the debt, aside from the pandemic, were the Trump tax cuts — skewed to the wealthy and large corporations — for $2 trillion.”

This is misleading for two reasons.

First, Trump’s tax cut, enacted in 2017, has not yet reduced revenue by $2 trillion; Biden is using an estimate for the period between 2018 and 2028. In reality, the CBO estimated the tax cut would reduce revenue by nearly $1.5 trillion through 2023, after accounting for positive macroeconomic feedback (which reduces the deficit) and additional debt service costs (which increases it).

Second, note that Biden referred to legislation passed “in the last decade.” That means he’s starting with 2013 — which conveniently leaves out a Barack Obama tax cut — the American Taxpayer Relief Act of 2012. (It’s a close call as to whether it belongs in 2012 or 2013. Despite the name, the Senate and House approved the bill on Jan. 1, 2013, and Obama signed it a day later.)

The revenue loss of Obama’s tax cut amounted to 1.8 percent of the gross domestic product, meaning it was double the size of Trump’s 2017 tax cut, according to the Committee for a Responsible Federal Budget — even though Trump often falsely brags he passed the biggest tax cut in U.S. history.

If you count Obama’s tax cut (plus another one he signed in 2010), it added almost $2.2 trillion to the deficit between 2013 and 2023, compared with $1.35 trillion for the Trump tax cut and $3.7 trillion for pandemic spending, according to an analysis of historical budget data. (These numbers do not include debt service costs.)

Why don’t you hear much about these Obama tax cuts? Democrats don’t tout them, in part because they extended about 80 percent of tax cuts first passed by George W. Bush in 2001 and 2003. Bush included a ticking time bomb — the tax cuts expired after nine years, forcing Obama to either extend them or allow taxes to go up for many Americans. He reached a deal that just raised taxes on people making more than $400,000. So Democrats often argue that those tax cuts, including what Obama extended, should be counted as GOP contributions to the deficit.

Trump included a similar ticking time bomb in his tax cut for whoever is president in 2025, as that’s when his tax cuts will expire. Biden has also engaged in these budget tricks for some of his spending programs, having them expire after a few years to make the fiscal consequences seem lower in the long run.

But Obama’s 2012 tax cut had important long-term fiscal implications.

He lifted the ceiling on the alternative minimum tax and indexed it for inflation.

That saved Congress from having to address the issue year after year, but it also

permanently drained those revenue. (Trump raised the ceiling further.)

Blahous said that Congress fiddles so often with the tax code that the effects of one particular tax cut are difficult to discern over a 50-year period. In doing his research, he said he was struck by the fact that policy choices made by Trump will have a greater long-term fiscal impact than his tax cut.

Trump eliminated several streams of revenue that Obama enacted to help

finance the Affordable Care Act, including a 40-percent tax on high-cost, employer-sponsored “Cadillac” health plans and fines imposed on people who failed to obtain health insurance. Blahous estimated that revoking these taxes will amount to 7.6 percent of the future fiscal imbalance. “One would never know that just following the political debates,” he said.

Looking strictly at legislation that affected the 2021 budget deficit,

Blahous attributes 38.2 percent of the deficit to policy choices made by Trump,

36.9 percent to Biden (primarily covid spending), 9.6 percent to Nixon,

8.6 to Obama, 3 percent to Johnson and 2.9 percent to George W. Bush.

Democrats prefer to frame the debate by just looking at the impact of policy since 2000. The last budget surplus was achieved in the 2001 fiscal year, which included the final four months of Clinton’s presidency. In 2000, U.S. debt held by the public was about 34 percent of GDP. As 2023 started, the amount of debt was 97 percent — an astonishing leap.

Under this analysis, which assumes Obama’s tax cuts should be counted as extensions of Bush’s tax cuts, roughly two-thirds of rise in the debt-to-GDP ratio can be attributed to three policies: the Bush tax cuts and the extensions (37 percent); the wars in Iraq and Afghanistan launched by Bush and sustained by his successors (18 percent); and the Trump tax cuts (10 percent). Pandemic emergency spending passed in 2020 accounts for 23 percent of the increase.

But this analysis sidesteps the fact that Obama signed into law two major tax cuts that contributed significantly to the nation’s long-term fiscal imbalance. The Obama White House celebrated the bill as reducing the federal deficit, and Obama was not reluctant to sign it. “This agreement will also grow the economy and shrink our deficits in a balanced way — by investing in our middle class, and by asking the wealthy to pay a little more,” Obama said in a statement at the time.

“The Great Recession and the covid crisis led to unusually large deficits due to congressional action (and in the Great Recession, losses of revenue due to a recession) right at the transition between terms,” said Eugene Steuerle, a fellow at the Urban Institute, in an email. The nation has experienced “ever higher deficits, which result partly from never having policies in place to pay off past crisis-level deficits (and growth in debt) and partly from the automatic growth in spending rather than just legislative increases.” Both parties, he said, have a “joint but growing responsibility for kicking the compounding entitlement shortfall down the road.”

Key points

1. The national debt, which has surpassed $30 trillion, shows how much the federal government owes. 2. All but two presidents since 1900 have contributed to the national debt, some more than others. 3. More significant contributions have been a result of government spending to finance wars and economic recovery.

While a country’s national debt and gross domestic product are often correlated,

too much debt compared to a country’s GDP can negatively impact economic growth.

The country’s debt has grown exponentially in the past few decades.

The federal government has countless programs to provide for its citizen’s various needs. But the ever-rising national debt is a constant reminder of the need for more moderated spending.

Many people like to see the national debt by the president to get an idea of how certain policies impact our government’s spending. They might use it as a political scorecard to gauge how well an administration is doing.

By the end of January 2022, the nation’s debt burden surpassed $30 trillion for the first time.Here’s how the U.S. debt by president breaks down.

National debt by president

The U.S. Treasury Department provides a detailed account of how much debt the country has piled up each year since 1900. From 1790 through 1900, the nation’s presidents accumulated $2.1 billion in national debt. Since then, presidents have seen both deficits and surpluses, but the deficits have grossly outpaced the surpluses, and the federal government hasn’t made more money than it spent in a year since 2001.

Keep in mind that presidents generally don’t have any control over the budget during their first year in office because it’s already set in stone by the previous president. We adjusted the figures to account for this fact.

Here’s how each president has contributed to that debt since the turn of the 20th century:

And the president most to blame for the national debt problem is …

The Debt Really Got Out of Hand in The Obama Green Jobs Revolution Years.

The Overall Picture

The U.S. Federal Reserve is once again Uncle Sam’s single largest creditor, accounting for 19.1% of the entire U.S. government’s national debt. The Fed’s share of the total public debt outstanding has grown from 16.5% a year earlier.

By contrast, the U.S. government’s second largest creditor is Social Security, whose share of the ownership of the national debt dropped from 10.4% of the total to 9.2%. Social Security has been running in the red since 2009, forcing its Old Age and Survivors’ Insurance Trust Fund to sell off U.S. treasuries it accumulated when it was operating in the black in order to keep paying out benefits at promised levels. Social Security’s share of the U.S. national debt is projected to decline to 0% in 2034. After that happens, Social Security benefits will be reduced by somewhere between 20-25% as promised under current law.

The retirement trust funds for the U.S. government’s military and civilian employees together account for 7.1% of the total U.S. national debt. After these large holdings, a diverse range of U.S. institutions, such as banks, insurance companies, independent corporations, investment firms and individuals combine to hold the largest share of money owed by the U.S. government, accounting for 38.6% of the total, down from the 40.4% share they held a year ago.

Foreign entities combine to account for holding 25.9% of the total debt liabilities issued by the U.S. government, up from the share of 25.4% they held on 20 January 2021. Of the portion of the national debt owed to foreign-based institutions, Japan now holds the greatest share at 4.5% of the U.S. national debt based on preliminary estimates, whose share is unchanged from a year earlier. China comes in second holding a share of 4.4%, which is down from 4.6% in 2021.

The international banking centers of Belgium, Ireland, and also Luxembourg saw

their share of the U.S. government’s total public debt outstanding held steady at 3.0%,

while the United Kingdom saw its share increase from 1.5% to 2.1% over the past year.

Brazil and the remaining foreign nations saw their shares of the U.S. national debt dip.

President Biden’s First Year in Office.

As we noted, the national debt increased by $2.11 trillion in President Biden’s first year in office. That amount was inflated by President Biden’s American Rescue Plan Act, which we estimate accounts for $1.34 trillion or 63.5% of the increase by itself. The following waterfall chart breaks down where most the money the U.S. government newly borrowed in President Biden’s first year in office came from:

We find the Federal Reserve loaned Uncle Sam 45% of all the net new borrowing.

Foreign entities loaned the U.S. government the second largest amount at 33% of

the net change, while U.S. individuals and institutions contributed the remaining 22%.

I think the most surprising part of the analysis is how much President Biden’s

“American Rescue Plan” contributed to the nation’s indebtedness.

That burden comes on top of its contributions to today’s inflation.

Incredible: Dianne Feinstein claimed she hasn’t ‘been gone’ when asked about her lengthy absence from the Senate: ‘No, I’ve been here. I’ve been voting’ (msn.com)

As you can see, every single president since 1900 other than Calvin Coolidge and Warren G. Harding has increased the national debt. Franklin D. Roosevelt added the most debt in terms of percentage increase, which was brought on by the New Deal.

NOTE: That program helped the country dig itself out of

the Great Depression and World War II. (NO IT DIDN’T.)

Woodrow Wilson added a large %increase to the national debt to finance World War I.

President George W. Bush was the first president to add a multi-trillion-dollar amount to the debt to finance the war on terror, and Presidents Barack Obama and Donald Trump followed suit, the former primarily to combat the Great Recession and the latter mostly to deal with the coronavirus pandemic.

It’s unclear yet how much President Joe Biden will add to the national debt, but the Congressional Budget Office projects that the country will add $1.3 trillion in deficit spending each year through 2030, totaling $13 trillion over that time. The Biden Administration’s legislation and executive orders in 2022—namely the Inflation Reduction Act and mass student loan forgiveness—could also impact the national debt in unforeseen ways.

If you’re paying way too much for housing, you’ve got plenty of company.

What makes up the national debt?

The national debt is composed of both public debt and intragovernmental debt. Public debt includes Treasury bills, notes and bonds, which are owned by U.S.-based investors, the Federal Reserve and foreign governments.

Intragovernmental debt is made up of Government Account Series securities that are owned by federal agencies, such as military retirement funds, public employee retirement funds and the Social Security Trust Fund.

Each year in which the government spends more than it earns in tax revenues,

it runs a deficit for that year, which adds to the national debt total.

How does the national debt correlate to the GDP?

Government spending is often designed to boost the economy, which means that the national debt and the country’s gross domestic product—the total market value of all goods and services produced within the country’s borders—are correlated.

“The national debt is typically scaled relative to GDP, because this allows investors to determine the total amount of the government’s obligations relative to its ability to repay these obligations,” says Rhea Thomas, an economist at Wilmington Trust.

“In addition, it allows for consistent comparison over time and across countries. Countries with high debt-to-GDP ratios tend to be associated with lower long-term growth.”

For the fourth quarter of 2021, the U.S. had a debt-to-GDP ratio of 123.39%, according to the Federal Reserve Bank of St. Louis. That’s almost double what it was in the fourth quarter of 2007, shortly before the Obama administration increased spending to deal with the Great Recession.

Poor America: A trailer park in California, where low-income citizens live

in stark contrast to wealthier U.S. residents

According to a study conducted by the World Bank, a ratio above 77% for a prolonged period could stymie economic growth. In all of this, it’s important to note that the federal government pays its debts with tax revenue, not GDP. Politicians continue to be at odds over how to generate revenues and how to spend those revenues.

“Paying back the debt will require higher taxes or reduced government spending,

both of which are difficult to do politically and result in slower growth,” says Thomas.

“Governments may also choose to print money to pay for debt, but this raises the risk

of runaway inflation and higher interest rates.”

Thomas also adds that as debt levels grow, investors may demand higher interest rates

out of concern over the government’s ability to pay its debts. Higher interest rates would,

in turn, take away from private investments, and it would also require more government spending to make larger interest payments, dampening productivity and long-term growth.

The national debt can be a politically polarizing issue, but it’s important to keep the context in mind for each president. As spending continues to rise without a correlated increase in revenues, the national debt will continue to increase, likely putting more financial strain on future generations.

Almost 40 million Americans live in houses they cannot afford.

Border agents released more than 6,400 migrants without court dates before being stopped by court order (msn.com)

Biden policy to release illegal migrants without court dates suffers another blow as judge extends block (msn.com)

Georgia takes a different path on homelessness than failing California and Oregon

Biden concedes victory to Manchin as vulnerable Democrat slams green agenda

Spending in America: How the poor, middle class and rich divided their incomes

There’s a ‘big red flag’ on this chart showing how Americans spend their money

These 4 Dems sent millions in earmarks to their spouses’ employers (msn.com)

Illegal border crossings declined yesterday as tensions grow in cities | Watch

Border Patrol Sees Record Number of Migrants Amid Massive Surge | Watch

White House signals what’s actually on the table in debt ceiling negotiations

Group of 30 Chinese migrants found near Texas-Mexico border (msn.com)