Harris reveals good-vibes economic policies. Experts weigh in.

Medora Lee USA TODAY

Democratic presidential nominee Kamala Harris revealed for the first time some big economic plans on Friday, but these experts had mixed reactions on how much some of them would help everyday Americans.

Harris, who said in a fact sheet she’s focused on “some of the sharpest pain points American families are confronting,” plans to ease rent increases, cap prescription drug prices for everyone, boost first-time home buyers, end grocery price gouging and bolster the child tax credit.

Many of these plans resonate with voters who have struggled in the past few years with soaring inflation, but some experts are wary of what they call “price controls” to fight high prices and how Harris intends to pay for some of her proposals.

Any changes to the tax code also would require congressional approval and depend heavily on which party controls the House and Senate, tax experts say.”It’s optimistic and targeted to improve the middle class; however, we have yet to see details, and it’s unclear how the congressional elections will impact the likelihood of passage,” said Mark Baran, managing director at consulting firm CBIZ MHM’s National Tax Office.

Former Republican New York congressman and senior vice president at business consultancy Alliantgroup Rick Lazio said in an email that the Harris campaign will need to consider “the societal costs of unsustainable higher public debt and its impact on inflation and the ability to respond to unplanned events, like recession, wars, pandemics, and natural disasters.”

The nonpartisan Committee for a Responsible Federal Budget estimated her full plan would increase deficits by $1.7 trillion over a decade and grow to $2 trillion if temporary housing policies were made permanent. “The Harris campaign has said this would be paid for through taxes on corporations and high earners and that they support the revenue raisers in the President’s fiscal year 2025 budget but has not put forward specific offsets as part of their agenda to lower costs for American families,” it said in a release.

To get a better view of what experts liked and questioned, USA TODAY has compiled a more detailed look of each proposal.

Child tax credit

A return to COVID-19-era child tax credit policies, which were $3,600 for qualifying children under age 6 and $3,000 for other qualifying children under age 18.

The credit is now $2,000 per qualifying child under age 17 and phases out for single filers earning over $200,000 and married couples with more than $400,000 in income. Republican vice presidential nominee JD Vance has floated a $5,000 credit and hinted at no income thresholds.

New, expanded tax relief of up to $6,000 for families with a newborn.

“We were super-excited to see her propose this big expansion,” said Mary Nugent, adviser of domestic policy at nonprofit Save the Children US. “To put it front and center and to be including this new kind of bonus for new parents with those youngest kids is really exciting in terms of the impact.”

Either Harris’ or Vance’s plan would reduce child poverty significantly , she said. The enhanced credit during the pandemic did so by half, she noted. “Most families would see an increased credit and, the top line there is that we would see massive cuts in child poverty.”

Health care and food prices

$35 price cap on insulin for Medicare recipients to cover insulin and annual out-of-pocket costs of $2,000 for all Americans, not just seniors.

Stiffer regulations and strict antitrust enforcement to prevent increased costs for consumers on drugs and food.

First-ever federal ban on price gouging on food and groceries.

The Groundwork Collaborative, a nonprofit progressive advocacy group, praised Harris’ push to hold companies accountable. “When just a handful of big companies control the majority of the market, or even control the market in a single region, they have the power to raise prices without worrying about a competitor nipping at their heels,” Lindsay Owens, the group’s executive director, said in a statement.

Economists were less enthusiastic, calling Harris’ efforts “price controls.”

“Harris is continuing with the Biden administration theme of blaming high inflation on corporate greed and price gouging – be it oil producers, pharmaceutical firms or, in this case, grocery retailers – rather than excessively loose pandemic-era fiscal and monetary policies,” wrote Paul Ashworth, chief North America economist for research firm Capital Economics, in a note. “She wants Congress to pass a federal ‘price gouging’ ban. It sounds uncomfortably like price controls, which could lead to product shortages.”

Housing

- Block data firms from increasing lease rates and prevent Wall Street investors from buying homes in bulk to resell at a premium.

- New tax incentives for builders who construct “starter homes.”

- Provide up to $25,000 in down-payment support for first-time homeowners.

“I’m encouraged by the recognition by Vice President Harris of the affordable housing crisis in America,” Lazio said. “There is no congressional district in the nation that hasn’t seen a spike in the housing supply imbalance. Having said that, the devil is in the details, and some of the initiatives like the subsidy for first time homebuyers regardless of their wealth or income needs to be rethought.”

Ashworth also noted many developed countries around the world “have tried to boost homebuilding but have struggled to achieve their goals because of capacity constraints in the construction industry or other bottlenecks, like zoning regulations.”

Tax-free tips:Trump, Harris agree on one thing: No taxes on tips. Here’s how it could impact the budget

What wasn’t discussed?

- Tax Cuts and Jobs Act, which expires at the end of 2025, is a massive tax package passed in 2017 that included provisions that touch almost every American. If it expires, tax rates for most Americans will rise, income brackets will narrow, and the standard deduction would get cut in half which could force many Americans to itemize again, among many other things.

It’s the “big elephant in the room,” Baran said. “Letting it expire completely will hurt middle-class Americans because tax rates will go up.”

Ashworth also noticed the lack of discussion “of whether she would support the extension of the original Trump tax cuts, even for those making less than $400,000 a year. That potential fiscal cliff that would hit at the end of next year is the real policy battleground.”

- No tax on tipped wages, which is a pledge Harris made at a rally in Nevada last weekend. Trump had made this proposal earlier.

This is “bad economic policy, but understandable from a political standpoint given that it could be enough to win the election race in Nevada,” Ashworth said. “Assuming there are limits on the amount of income that can be counted as tips and that only income taxes are eliminated rather than payroll taxes too, that tax cut might cost up to $150 billion over the next decade.”

- Small and medium-sized businesses.

“I’m disappointed that there was nothing today that spoke to the need to protect and incentivize these businesses that employ half of all Americans, and up until recently have generated most of the industry innovation in America,” Lazio said. He said he’d like to see Harris endorse tax incentives for research and development to spur innovation and to keep tax rates for small businesses steady.

“Small-business people are middle-class people, too,” Baran said.

Medora Lee is a money, markets, and personal finance reporter at USA TODAY. You can reach her at mjlee@usatoday.com and subscribe to our free Daily Money newsletter for personal finance tips and business news every Monday through Friday morning.

What’s next for Kamala Harris?

Kamunism unveils budget breaking $1.7 trillion economic plan – Search

Her ‘plan’ calls for doling out $25,000 for down payments by up to 3 million first-time home-buyers,

plus $6,000 tax breaks for ‘lower and middle’ income families with children up to a year old.

By Diana Glebova, Josh Christenson and Victoria Churchill | The New York Post

RALEIGH, North Carolina — Vice President Kamala Harris on Friday unveiled the economic policies she would enact in her first 100 days in office — and it comes with a whopping estimated $1.7 trillion in handouts, as well as government price controls on groceries amid ravaging Biden-Harris administration inflation.

Her economic plan includes measures to dole out $25,000 to help first-time homeowners with their down payments and give up to $6,000 tax breaks for lower and middle-income families who have a child in their first year of life. Harris did not say what incomes qualify as “lower” and “middle.”

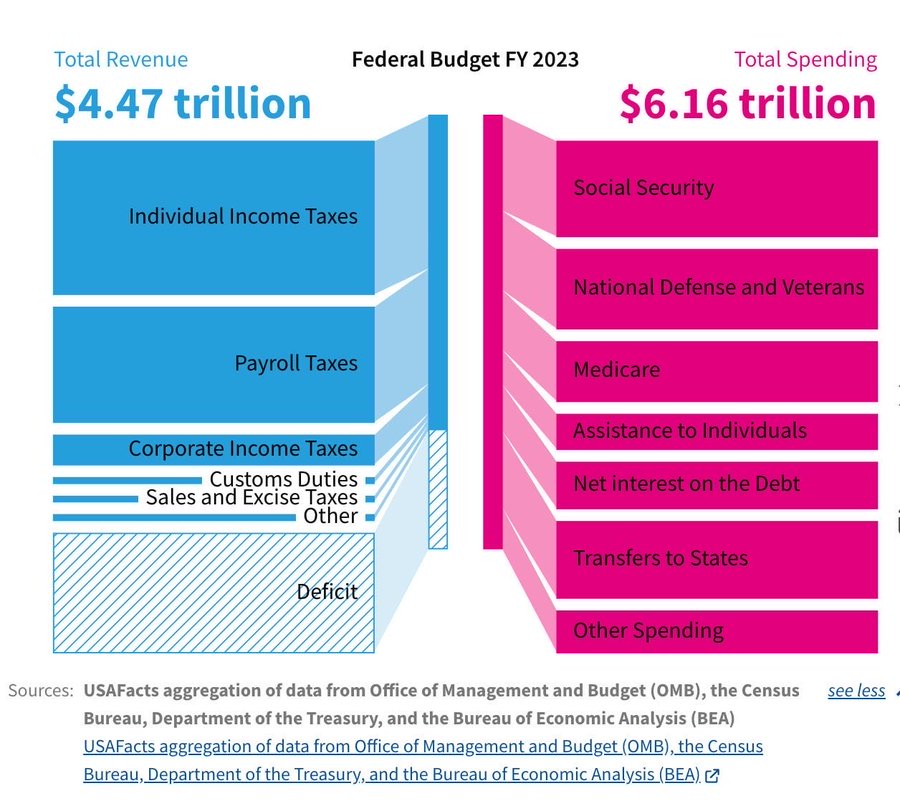

The housing subsidies alone are “absolutely inflationary” and would “push a $2 trillion dollar deficit even higher,” Brian Riedl, a senior economic fellow at the Manhattan Institute, told The Post, referring to the already projected budget shortfall for 2024. Those subsidies make up just $200 billion of the total $1.7 trillion handouts pledged to voters.

Economists warn that Harris’ price control plans could force small businesses to close. AP

‘Reckless’ handouts

A slew of economists The Post spoke to have already slammed the plan’s hefty price tag amid an already-struggling economy.

“The CRFB estimates make it clear that the Harris agenda—like Biden’s before it—will be fiscally reckless and economically damaging,” Adam Michel, the director of Tax Policy Studies at the libertarian Cato Institute, told The Post.

“Writing people large checks and enforcing price controls is a recipe for expanding demand and shrinking supply, creating shortages and necessitating rationing,” Michel said.

“The $6,000 child tax credit is the next entry in the child tax credit arms race, in which Republicans and Democrats are trying to outdo each other in writing Americans ever bigger checks. It will only get more expensive from here.”

“This is very reckless to be adding this type of debt to our already existing mountain of debt,” said Joel Griffith, an economic research fellow at the Heritage Foundation, told The Post in reference to the rising national deficit that currently sits at $34 trillion and is expected to reach $50 trillion by 2034.

The nonpartisan Tax Foundation in an analysis was particularly troubled by the lack of detail she provided over where the funding for the handouts would come.

Here’s what you need to know about Kamala Harris’ plans for the economy

- Harris plans to reduce grocery costs, which includes working with Congress to ban “price gouging,” or stopping sellers from pricing their products excessively.

- Harris promised to work toward construction of three million new homes to “end the housing shortage” within a four-year time frame, offering a first-ever tax incentive to people building starter homes.

- The Harris campaign is running on expanding the Child Tax Credit to give middle-income and lower-income families up to $6,000 in tax breaks for families who have children in their first year of life.

- Harris wants to “to cancel medical debt for millions of Americans and to help them avoid accumulating such debt in the future,” capping insulin costs at $35 and out-of-pocket prescription drug costs at $2,000.

“Harris’s agenda is missing details on how her proposed tax subsidies and expansions in federal programs would be paid for, risking a worsening debt trajectory,” the foundation said in an analysis.

“The combined cost of the proposals would likely exceed $2 trillion over 10 years, putting upward pressure on inflation to the extent they are deficit-financed and leading to a further prolonging of the Federal Reserve’s high-interest-rate stance.”

Harris is also proposing giving tax incentives to businesses who build affordable housing and to those Americans building houses themselves and is planning to build 3 million more homes in the next four years.

“Harris’s tax agenda is problematic for three major reasons: it would further entrench social policy and spending into the tax code, it would subsidize home buyers rather than address supply constraints, and it does not specify sufficient offsets to pay for the subsidies, worsening an unsustainable debt trajectory,” the Tax Foundation said.

EJ Antoni, a public-finance economist at The Heritage Foundation, told The Post that “the Harris agenda is even worse than the Biden agenda: it means more spending, more borrowing, and more money printing to pay for it all.

“The economy is already suffering under an increased regulatory burden from the last 3 1/2 years of overregulation and this agenda would send those cost increases into overdrive.”

”Harris’ economic proposals are a recipe for higher inflation and widespread shortages of basic items necessary for living like food and housing,” added Cato budget and entitlement policy director Romina Boccia.

Price controls

The Trump campaign has especially taken issue with her price control policies, calling them “communist” and comparing her proposals to those of authoritarian leaders in Venezuela and Cuba.

“When the government comes in and takes over food production and sets prices, that inevitably leads to food shortages and even famines,” economist Kevin Hassett said in a Trump campaign press call.

Harris blamed the high grocery prices on the supply chain disruption during the pandemic, but admitted that costs have remained high even after the logistical issues got better in the years since the height of COVID.

“A loaf of bread costs 50% more today that it did before the pandemic. Ground beef is up almost 50%” she said, oddly referring to the lower costs under the Trump administration.

That’s why she thinks federal price limits are needed for the first time in US history.

“We know that many Americans don’t yet feel that progress in their daily lives, costs are still too high, and on a deeper level, for too many people, no matter how much they work, it feels so hard to just be able to get ahead,” Harris said in Raleigh at her campaign stop.

“As President, I will be laser focused on creating opportunities for the middle class that advance their economic security, stability and dignity. Together, we will build what I call an opportunity economy.”

But economist Stephen Moore in the Trump campaign call said “the average margin for a grocery store or 7 Eleven sell food is between two and three percentage points,” predicting that “many of them will go out of business” with price controls.

Riedl agreed, telling The Post that “price controls do not eliminate inflation — they only delay it, with huge shortages in the meantime.”

The Trump campaign has stressed that Harris is currently in office as vice president and has presided over the economy for the last three and a half years.

Harris argued that Trump did not offer concrete policy proposals in his speech on the economy that he did on Thursday.

In his speech standing in front of groceries, Trump blamed Harris for the current economy and said he would “drill baby drill” when he got back into office, lowering the price of energy.

He also said he would free up federal land to build more houses on and work to reduce the price of energy by 50%.

Harris has not yet revealed her energy policies, other than her campaign telling reporters that she has reversed her 2020 presidential campaign position that would have banned fracking. ## The New York Post e-Edition

Harris’s economic pitch could cost $1.7 trillion: Analysis

by Aris Folley – 08/16/24 5:25 PM ET

Vice President Harris speaks during an event to discuss the administration’s efforts to lowering prescription drug prices at the Prince George’s Community College in Upper Marlboro, Md., on Thursday, August 15, 2024.

Vice President Harris’s recent proposals laid out as part of her Agenda to Lower Costs for American Families could increase the nation’s deficits by $1.7 trillion over a decade, a new analysis found, though the campaign is vowing offsets through taxes on the rich.

Harris unveiled several proposals Friday as part of her agenda for the economy if she wins the presidency later this year, including a measure that would beef up the child tax credit (CTC) to provide a $6,000 tax cut to families with newborn children.

The plan also calls for the restoration of an expansion to the CTC that was passed as part of a sweeping coronavirus relief package in 2021 known as the American Rescue Plan, pressing for up to $3,600 per child tax credit for some families.

In an analysis from the Committee for a Responsible Federal Budget (CRFB) released later on Friday, the group estimated Harris’s proposals to expand the CTC could come with a price tag of $1.2 trillion from fiscal 2026 through 2035.

Other measures proposed in the plan that would expand the earned income tax credit (EITC), set up a tax credit for first-time homebuyers, extend the Affordable Care Act premium tax credit expansion and efforts to support affordable housing, could cost upwards of $700 billion during the same time frame, CRFB noted.

The group estimates the proposed plan could cost $1.95 trillion over 10 years, but notes that figure could climb to $2.25 trillion if some of the proposed housing measures set to take place if Harris is elected are made permanent.

However, the group says the estimated cost is “partially offset” through other agenda items aimed at lowering prescription drug costs that could help generate “roughly $250 billion of savings.”

“The Harris campaign has emphasized that the major housing policies would only be in effect for four years. However, if they were extended permanently, the fiscal impact would grow to $2 trillion,” the group said.

2024 campaign heats up as Harris unveils economic planVice President Kamala Harris on Friday unveiled a populist economic agenda, proposing a new plan to provide tax relief for more than 100 million middle-class and lower-income Americans as she builds out the details of her governing agenda weeks after locking down the Democratic presidential nomination. CNN political and economics experts weigh in with their reactions. 00:00–9:59 CNN’s Wolf Blitzer speaks with CNN reporters and political analysts about Harris’ plan and how the Trump campaign is reacting. 10:00–17:37 CNN’s Phil Mattingly speaks with CNN economics and political commentator Catherine Rampell and Heritage Foundation distinguished fellow Stephen Moore about how Trump and Harris are approaching the economy. 17:38–22:56 CNN’s Wolf Blitzer talks with North Carolina Gov. Roy Cooper, who attended Harris’ speech in the state. 22:57–30:49 CNN’s Sara Sidner is joined by CNN senior political commentator David Axelrod and former Mitt Romney presidential campaign chief strategist Stuart Stevens about how the two candidates are preparing to debate.

Department of Government Efficiency @DOGE

In FY2023, the U.S. Government spent $6.16. trillion while only bringing in $4.47 trillion. The last budget surplus was in 2001. This trend must be reversed, and we must balance the budget.

‘Hit By A Sledgehammer’: Trump’s Second Victory Seemingly Deals Death Blow To #Resistance

Our universe has an anti-universe twin moving backwards in time, study finds.

Harris pledges to tackle costs, build houses, lower taxes in economy speech | Reuters

Kamunism Harris unveils budget breaking $1.7 trillion economic plan – Search

12 Photos of Chernobyl that Prove Humans Are Destroying the World

The Electoral Problem for Democrats: It’s the Neoliberalism, Stupid

House Democrats prepare to make Mike Johnson’s life hell